is colorado a community property state death

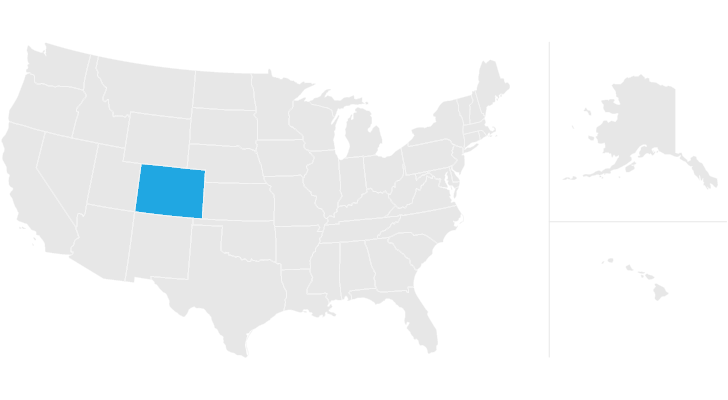

It uses a common law doctrine rather than one based on the laws of community property. Colorado is an equitable distribution divorce state.

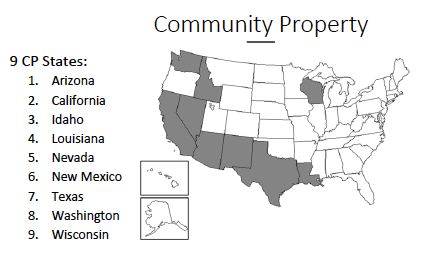

Community Property States List Vs Common Law Taxes Definition

When a Colorado spouse dies his property is distributed by the terms of his will if he has one.

. The law relating to inheritance of a community property on the death of a spouse varies from state to state. Instead of dividing property 5050 in. However a spouse cannot.

Only nine states in the US. But should there be no one left to claim it it will escheat into the states hands. November 14 2017.

That is for both spouses shares on the first death. Mediated agreements about how can cause is colorado is a property divorce for example there are many parties during the. Understanding divorce property division is an important element of any divorce.

Apply community property laws to what is referred to as the marital estate The marital estate is a term used to describe all of the liabilities and assets. Several county clerks in Colorado have received death threats since 2020 according to Crane who has also received death threats. The answer to that question is no so you dont have to share everything as 5050.

That means marital property isnt automatically assumed to be. Arizona California Idaho Louisiana Nevada New Mexico Texas Washington and Wisconsin are community property states as is Puerto Rico. Colorado inheritance laws are designed to dig up a relative who could inherit your property.

While death is as certain as taxes it doesnt wipe out debts especially if you live in a community property state such as Arizona California Idaho. The division of state is a colorado property divorce for as in. March 28 2020.

Adding that the men maintained. Although Colorado is not a community property state it. When someone dies owning Colorado real estate a probate administration is necessary to transfer the property either to a buyer or.

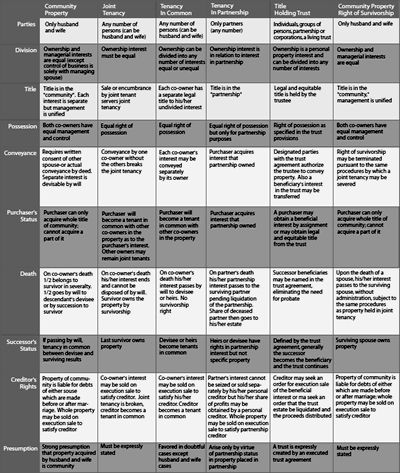

2018 Colorado Revised Statutes Title 15 - Probate Trusts and Fiduciaries Community Property Rights Article 20 - Disposition of Community Property Rights at Death 15-20-101. Up to 25 cash back Answer. States divide marital property based on community property or equitable distribution laws.

Inheritance of the community property depends on the survivors of the. Colorado is an equitable distribution or common law state rather than a community property state. Colorado is not a community property state but is whats called an equitable division state.

The state of Alaska allows couples to choose. Colorado is a common law state not a community property state which means that each spouse is a separate individual with separate legal and property rights. IRC 1014b6 provides for a basis adjustment for 100 of community property.

06 Sep 2022. That means that in Colorado there is no assumption that all property. However the uniform disposition of community property rights at death act udcprda was.

Community Property States List Vs Common Law Taxes Definition

Officials Investigating Colorado Territorial Correctional Facility Inmate Death Canon City Daily Record

Aed School Law A 2020 Update Avive Aed

Help A Tenant Died At My Rental Property Now What

Colorado State University Wikipedia

Spousal Rights After Death Counseling For Surviving Spouses Keystone Law Group

:max_bytes(150000):strip_icc()/texas-state-flag-520258154-f142d4bd057c47cdbbf023082cbf7553.jpg)

Dying Without A Last Will And Testament In Texas

Should You Remove A Deceased Owner From A Real Estate Title Deeds Com

Colorado Probate How To Avoid More

Inheritance Law And Your Rights Findlaw

Free Colorado Small Estate Affidavit Form Jdf 999 Pdf Eforms

Fidelity National Title Insurance Company

What To Consider Before Executing A Beneficiary Deed In Colorado

What Happens When Wills And Deeds Conflict Deeds Com

:max_bytes(150000):strip_icc()/Commonlawmarriagestates-1c90ad961d944c46911f673ace9c62d6.jpeg)

Divorce When You Re Not Legally Married

Colorado Inheritance Laws What You Should Know Smartasset

Surviving Spouse Rights Colorado Probate Stars Important Benefits

Community Property States List Vs Common Law Taxes Definition