geothermal tax credit 2021 irs

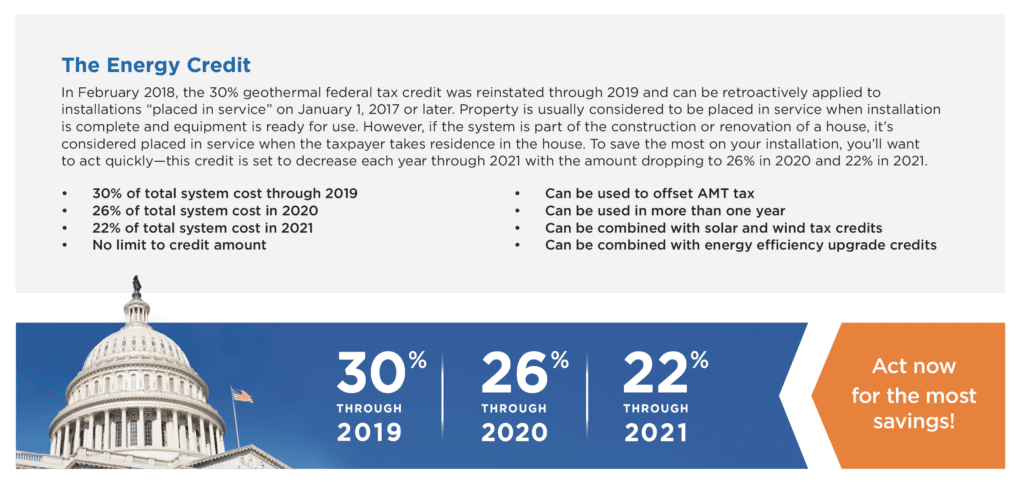

The LLC owners are in a 40 marginal tax bracket when state income tax is. Federal Geothermal Tax Credits have recently been amended thus you may have 26 Federal Geothermal Tax Credits to get for systems installed by Jan.

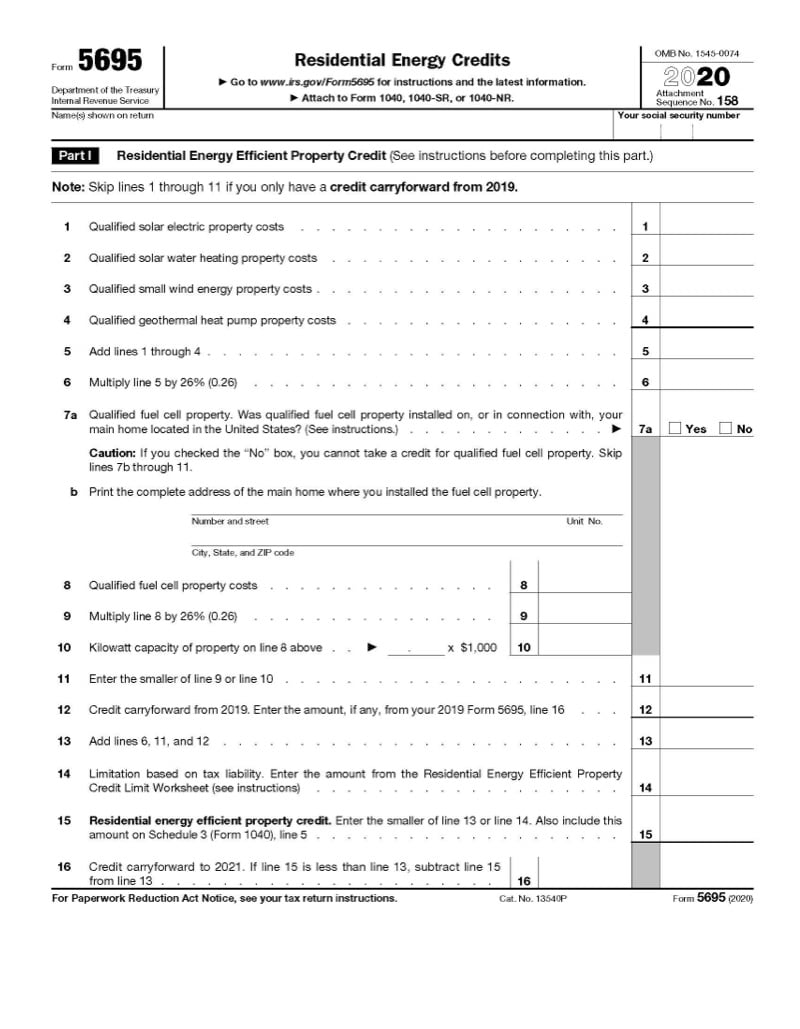

Steps To Complete Irs Form 5695 Lovetoknow

Geothermal heat pumps that were origionally installed in 1992.

. All tax credits on these products are eligible until December 31 st 2021. Also enter this amount on Form 5695 line 14. Start Your Tax Return Today.

45000030 or 15000 x 26 3900 per condominium REPLACEMENT UNIT EXAMPLE The taxpayer spends 12000 to install a new geothermal heat pump property. Start Your Tax Return Today. The incentive will be lowered to 22 for systems that are installed.

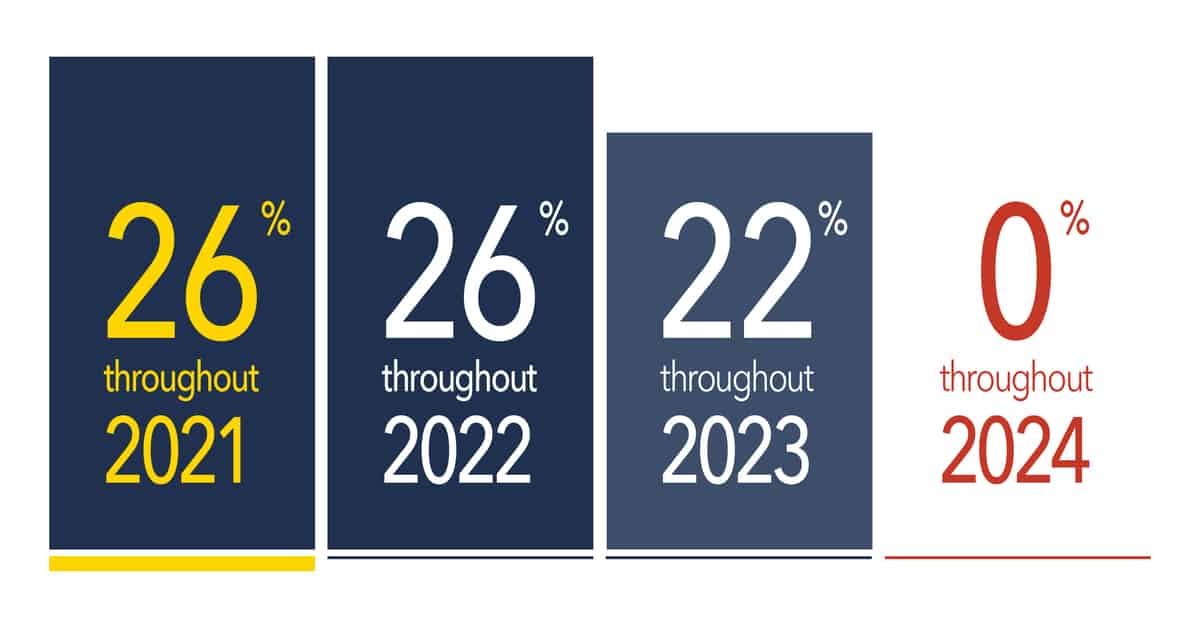

The 26 federal tax credit was extended through 2022 and will drop to 22 in 2023 before expiring altogether so act now for the most savings. Subtract line 2 from line 1. The Geothermal Tax Credit is classified as a non-refundable personal tax credit.

Updated April 27 2021 A. Under the Consolidated Appropriations Act of 2021 the renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a gradual step down in the. For purposes of taking the.

Ad All Major Tax Situations Are Supported for Free. The tax credits for residential renewable energy products are now available through December 31 2023. What you need to know about the geothermal tax credit - Recently the 30 tax credit for geothermal heat pump systems was reinstated after a fight to extend it took place.

Taxpayers who upgrade to renewable energy systems for their homes such as solar panels or geothermal heat pumps may be eligible for a nonrefundable tax credit of up to. In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount. A 26 federal tax credit for residential ground source heat pump installations has been extended through December 31 2022.

Fortunately the Geothermal Tax Credit allows homeowners to apply their tax credit over multiple years. However after 2019 the. Who Can Take the Credits You may be able to take the credits if you made energy saving improvements to your home located in the United States in 2021.

In December 2020 the. The project is completed in the 3rd quarter of 2020. Federal Geothermal Tax.

Ad All Major Tax Situations Are Supported for Free. A home is where you. The credit is worth 30 for upgrades made before December 31 st 2019.

Renewable energy tax credits for fuel cells small wind turbines and geothermal heat. Form 5695 2021 Residential Energy Credits Department of the Treasury Internal Revenue Service Go to wwwirsgovForm5695 for instructions and the latest information. If zero or less enter 0 on Form 5695 lines 14 and 15.

The ITC extension will allow homeowners who install a geothermal. If your tax burden in 2021 is less than the full amount of your credit. Great news the Federal Investment Tax Credit ITC for geothermal has been extended through 2023.

Geothermal heat pumps are similar to ordinary heat pumps but use the ground instead of outside air to provide heating air conditioning and. It is an amount that is applied to your tax liability what you owe to the IRS in order to reduce or eliminate. Into law on December 20 2019 extends the production tax credit PTC and investment tax credit ITC for qualifying wind energy projects and qualifying closed-loop biomass open-loop.

Form 5695 For 2021 2022 Energy Tax Credits

How To Claim The Solar Tax Credit Itc Irs Form 5695 Forme Solar

Irs Form 5695 Lines 1 4 Irs Forms Irs Tax Credits

What Federal Tax Incentives Are There For Geothermal Heat Pumps

The Alliance For Green Heat Federal Tax Incentives For Wood And Pellet Stoves Sustainable Local And Affordable Heating

The Federal Geothermal Tax Credit Your Questions Answered

300 Federal Tax Credits For Air Conditioners And Heat Pumps Symbiont Air Conditioning

Renewable Energy Production Tax Credits Irs Releases 2020 Inflation Factor Reference Prices Alerts Barnes Thornburg

Form 5695 Instructions Information On Irs Form 5695

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

Form 5695 Claiming Residential Energy Credits

10 Tax Breaks You May Be Overlooking Wfla

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac

Federal Tax Credits For Home Energy Projects

How To Claim The Federal Solar Investment Tax Credit Solar Sam

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac

Filing For Residential Energy Tax Credits What You Need To Know

Irs Releases 2021 Section 45 Production Tax Credit Amounts Mayer Brown Tax Equity Times Jdsupra